Since 1993 we’ve helped position, launch and scale some of the most successful businesses and brands in the world.

We’ve served brands and businesses across a range of sectors and multiple industries worldwide — including tech and life sciences, eCommerce, mobile, social media — and many companies stay with us through every stage of their journey.

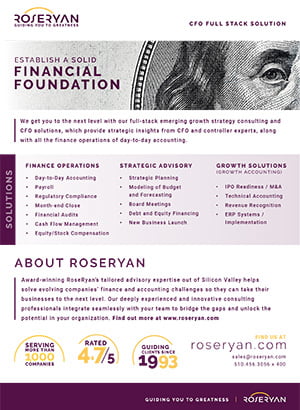

Our deeply experienced, innovative on demand Financial, Accounting and Marketing management consulting and advisory services resources will jump in to meet your pressing needs, bringing targeted levels of expertise at the right time, to suit your company’s requirements and appetite.

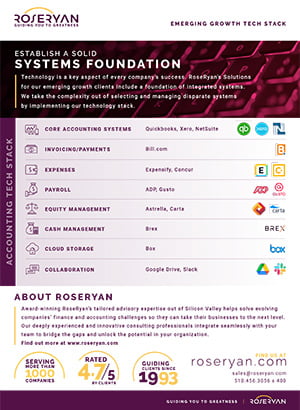

We provide our clients with a full complement of flexible, bespoke outsourced Finance & Accounting, and Marketing solutions so they can power their businesses towards profitable growth, and lasting success.

From outsourced, on demand, fractional, to interim, to project work — or long-term — resources, our seasoned, multi-talented professionals will bridge any skills gaps, and integrate seamlessly with your team — to offer the data, knowledge, creativity and reinforcement your organization requires to achieve its aspirations.

Since RoseRyan was founded, we’ve been offering transformative, reliable guidance to a multitude of early stage, high-growth and maturing companies in the Bay Area and beyond, nationally and internationally.

Contact us today to learn more about how we can work together to create value for your early stage or startup business. Tell us how we can help.