To set up a fast-moving company for continued growth, a strong technological backbone is a must. The systems you put in place affect how well you understand what’s happening at your emerging growth company and where it’s headed. With so many options on the market today, it’s easy to miss out on essential tools as you build out your tech stack.

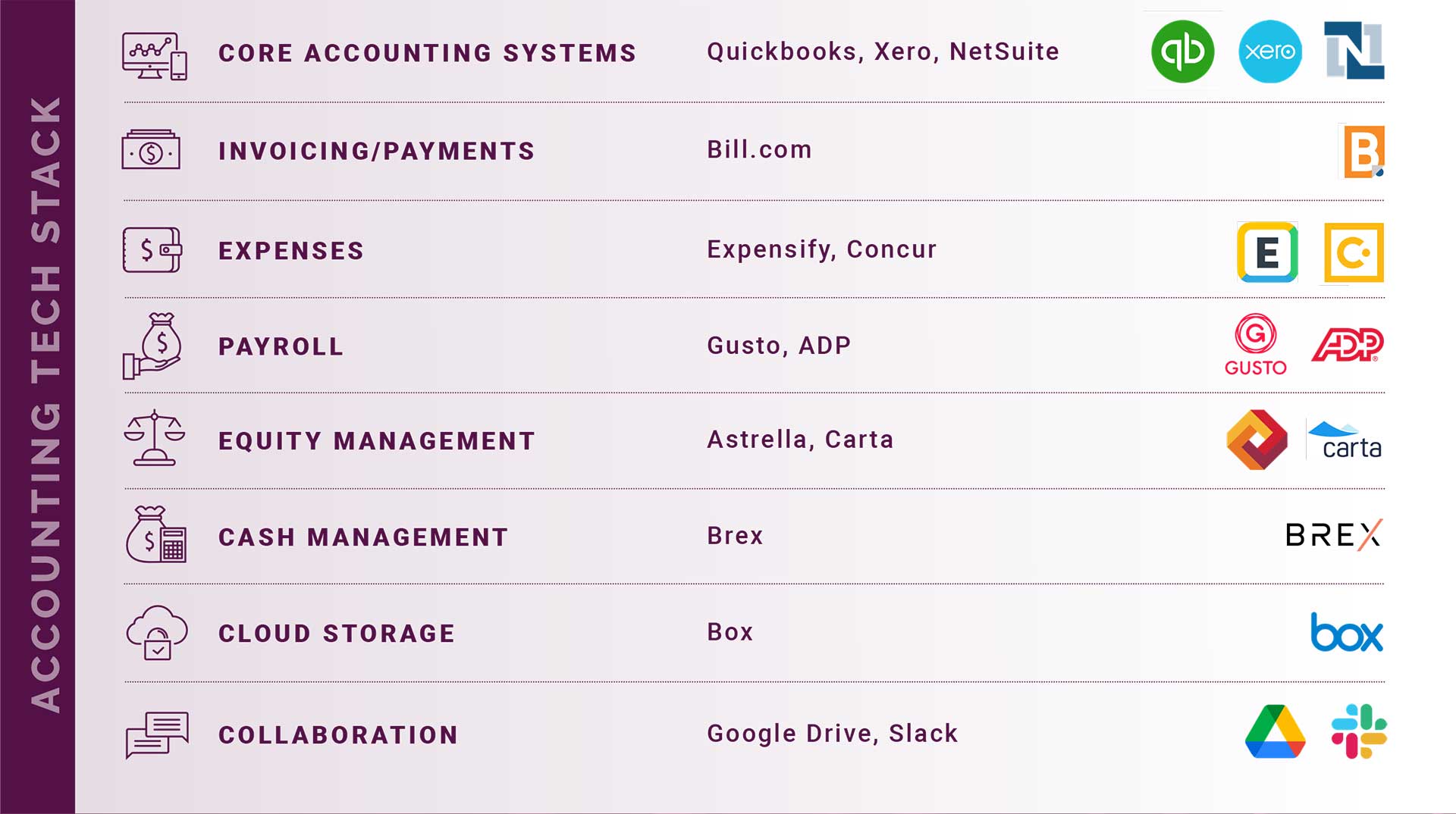

For the finance team, a tech stack of integrated applications can reduce redundancies and manual entries while opening up a clearer view of the business today—as well as its future. Included in this tech stack is your core accounting system, of course, but also how you manage expenses, payroll, cash and more.

IT security and management layer. Start out with a good foundation, one that takes risk management into consideration. At many companies, the IT infrastructure is often put in place piecemeal by tech-savvy founders or software engineers, who are mainly focused on developing and delivering the product or service. The company’s security and infrastructure is viewed as a distraction and ends up getting implemented that way.

What tends to fall through the cracks with that approach is a base layer of security—the company’s data, its clients’ data and the networks being accessed need to be secure at all times. RoseRyan has helped companies address this issue by turning to one of our trusted partners, RSM, for implementing and maintaining appropriate security technology and making sure that the whole company has its vulnerabilities identified and remediated.

Accounting software: QuickBooks Online is the de facto industry standard for a startup, but Xero is a great low-cost option as you get going. Then as you grow your business, options open up as does complexity. Before making a significant commitment to moving into a next-level system, you’ll wonder: As my company expands internationally, starts manufacturing or gets into more specialized areas (or all of the above), is QuickBooks still filling my needs? Or do I need to go to NetSuite or Sage Intacct or some other larger more complex system? Do I have the staffing and/or am I willing to commit to the staffing and investment necessary to make this tool work for my business?

The experts helping you grow and scale your business can help to answer these questions.

Invoicing/payments software: In an emerging growth company’s debate over whether QuickBooks, Xero or NetSuite is best, there’s a “pain point” that tends to get lost: How will you manage all the bills and payments day in and day out? Doesn’t your accounting system handle payments? Well, yes and no. While you can account for your payments and pay through QBO, that doesn’t mean that invoices and payment history are easily accessible in the detail that you may need it. That’s where Bill.com offers a great addition to your tech stack. Particularly as paper invoice files fade into a distant memory, a system that keeps this information organized and accessible becomes an invaluable tool.

Another more specialized form of payments software is your expense tracking system. There are many different systems available—some one purpose and some that have expanded out into doing other functions. Divvy is a great addition to the scene that handles credit card management, expense tracking and approval processes. Bill.com liked it so much that they bought the company.

While your accounting software can be used to pay the bills, Bill.com offers an incredible level of ease of use. Use it to seamlessly onboard and integrate vendors into your system, and then you’ll have a data warehouse of all your payments.

FP&A tools previously out of reach or performed in Excel: Some phenomenal FP&A tools used to be exceedingly expensive and rarely considered outside of companies that are well beyond the emerging growth category. Now emerging growth companies can take advantage of planning software like Budgyt, LivePlan and Spotlight Reporting with relatively attractive monthly pricing plans. And more importantly, you can get out of the Excel mindset and risks for doing your planning.

Integrate one of these applications with your accounting software, and transition from solely relying on historical accounting data to looking forward. What are the implications of introducing a new product? What would a realistic roadmap for growth over the next couple of years look like? These products can help you with these questions, provide management with a user-friendly view, and enable rigorous slicing and dicing of data (such as pulling out P&L by product line or productivity by salesperson and creating scenario management in such a way that new what-ifs don’t get confused with the plan that you’re committed to for the year).

Payroll and or PEO systems: Anyone who applied for a PPP loan in 2021 found out that payroll systems and PEO companies are not created equal. Which company you use and which way you go (payroll vs PEO) may significantly impact the amount of time you spend servicing monthly tax filings and the ease with which you’re able to bring on new employees wherever they are available. Some companies, like Rippling, provide not only PEO and payroll options, but combine other services as well.

Industry-specific solutions for inventory and manufacturing: A number of the popular accounting systems mentioned above, including QuickBooks, do not meet the inventory management needs of manufacturing companies. Smaller manufacturers need fresh ideas on more flexible solutions that meet their company where it is today. With expert tech stack advice, you can find a number of systems providers with solutions that fill those gaps long before you’ll need to transition to a full ERP system costing multiple millions of dollars.

Completing Your Tech Stack

The above is just a broad overview of the types of systems to be considered. In future blogs we’ll take deeper dives into some of these areas, but the number of products out there and the range of possibilities for getting a better handle on your business and all of its growth potential can be overwhelming. Finance consultants who have deep experience using an array of the latest tech solutions can guide you with objective recommendations that are appropriate for your company.

At RoseRyan, our finance and accounting experts have been a part of the selection, implementation and training process, and can use these experiences and connections to trusted partners, such as RSM, to steer you toward the right solution and get the team up to speed with the software you ultimately choose. It’s all part of the many ways RoseRyan consultants guide companies to greatness.

Andrew Katcher, a consulting CFO for RoseRyan, blends financial, supply chain and systems skills with vast international experience, having held Fortune 500 division-level controller positions in Japan, Korea, Australia, Europe, Israel and Singapore, in addition to serving as an interim CFO for U.S.-based companies. Past consulting clients include Facebook (Oculus division), SanDisk, Logitech, Amazon/Lab126, SunPower, NYK Logistics and Core-Mark. He recently led a company through an acquisition while guiding two other companies through successful Series A financing rounds.